Hr Hmrc

Hmrc Phone Fail Set To Escalate Thehrdirector

Time Saving Payroll Software For Small Businesses Citrus Hr

Human Resources Profession Gov Uk

Eliminate Your Fears And Doubts About Voluntary Disclosure And Tax Enquiries With Hmrc

Are Hmrc Systems Fit For Purpose Thehrdirector

Foi 2619 14 Mr A Prue Pdf

HMRC digital jobs As a digital employer with some of the best delivery centres in the UK and some of the biggest and most exciting digital projects in Europe we’ve got a lot to offer Why work for HMRC digital?.

Hr hmrc. HMRC will check claims made through the scheme Payments may be withheld or need to be repaid in full to HMRC if the claim is based on dishonest or inaccurate information or found to be fraudulent HMRC has put in place an online portal for employees and the public to report suspected fraud in the Coronavirus Job Retention Scheme. The amount of the claim (or a reasonable indication of it) The information will remain on the HMRC website for a year. HMRC, Her Majesty’s Revenue and Customers, is a department of the UK government responsible for tax collection, payment of various forms of state support and the administration of regulatory regimes.

HMRC given new powers under the UK Finance Act 23 September Raj Laxman Coronavirus Job Retention Scheme From the 22 July the HMRC have been granted the statutory authority to claw back any nonentitled payments made to employers through the Coronavirus Job Retention Scheme and any other COVID 19 financial support payments. An experienced Human Resources Professional with demonstrated history of working in the finance services Sector Skilled in Pay and Reward, business partnering, talent management, coaching,. Wealden HR & Payroll Solutions 343 followers on LinkedIn Innovative Cloud Based HR and Payroll Software Solutions Company Since 19, Wealden has been providing industryleading HR, Payroll.

HR Director, HMRC Customer Services Group United Kingdom 6 connections Join to Connect HM Revenue & Customs Report this profile Activity Line manager, leader, your boss can make or break your experience in work How will you make your team's experience great today?. Expert, personable HR and training solutions that are tailored to your business From crisis to compliance, coaching to qualifications, we offer customised human resources and learning and development support for businesses, schools and charities of all shapes and sizes. HMRC has published revised guidance on the Coronavirus Job Retention Scheme (CJRS) scheme which applies from 1 November We’ve updated our Q&A document but these are the highlights 30 November is the last day to make claims under the old scheme which applied until 31 October.

At HMRC we're committed to getting tax right, for everyone We’re all doing our bit to make a difference, whether that’s helping customers pay their tax and claim financial support or making it hard for the dishonest minority to cheat the system We couldn’t do all this without our dedicated and very important workforce. Let Reio take care of payroll calculations and submissions to HMRC Core HR Manage employee work time, approve holidays and sick day requests from within Reio Integrations Reio is integrated with Xero, Google Suite and other popular software packages FIND OUT MORE Pricing. Head of HR Policy HMRC Apr 18 – Present 1 year 7 months Canary Wharf London Head of Employee Relations HMRC Feb 15 – Present 4 years 9 months Head of Talent and Capability.

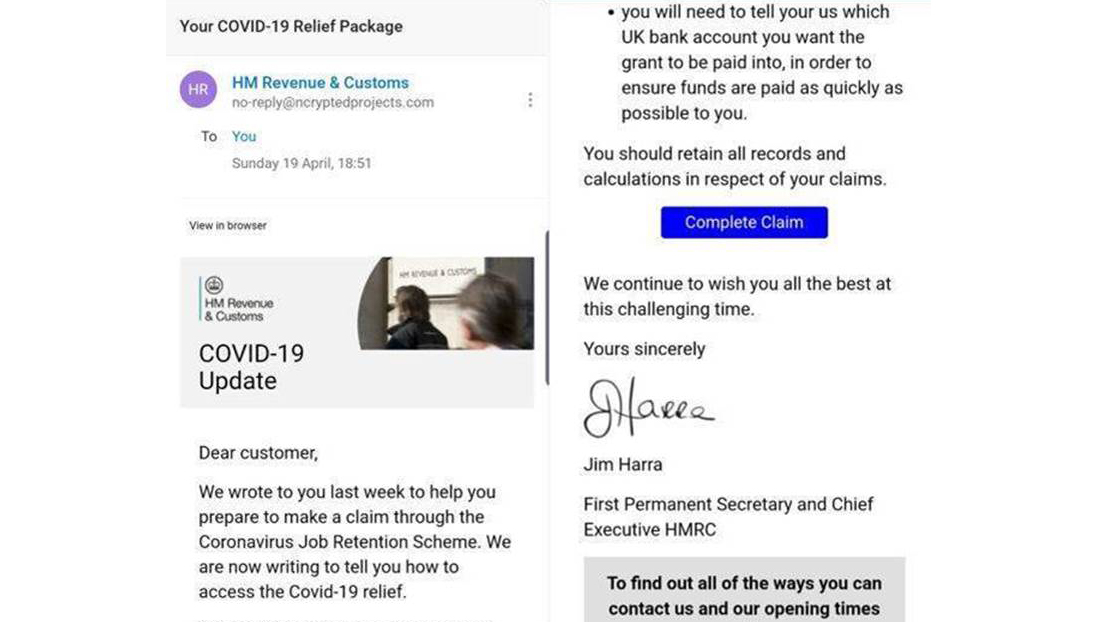

Current vacancies Industrial placements 21 Useful links All GOVUK blogs;. At HMRC we're committed to getting tax right, for everyone We’re all doing our bit to make a difference, whether that’s helping customers pay their tax and claim financial support or making it hard for the dishonest minority to cheat the system We couldn’t do all this without our dedicated and very important workforce. Emailing HMRC gives you more control and is a more efficient way of communicating The digital trail also reduces the chance of documents getting lost Once you know the full name of the individual it’s straightforward to work out the email address it’s normally firstnamesecondname@hmrcgovuk so, First Permanent Secretary (and Chief Executive) Jim Harra , can be mailed as jimharra@hmrcgovuk.

HM Revenue and Customs (HMRC) is the UK’s tax, payments and customs authority We collect the money that pays for the UK’s public services and help families and individuals with targeted financial. Head of HR at HMRC CDIO London, United Kingdom 500 connections Join to Connect HMRC CDIO University of Wales, Cardiff Report this profile About An experienced Human Resources Professional with demonstrated history of working in the finance services Sector Skilled in Pay and Reward, business partnering, talent management, coaching. HM Revenue & Customs (HMRC) We are currently undergoing a major transformation programme to create a tax authority fit for the future As part of this, we are committed to providing highquality.

The Office of Human Resources (OHR) provides leadership for the development, execution, and management of the human resources program to ensure the Department builds and retains a highly skilled and diverse workforce. HR Leader for HMRC Glasgow Regional centre & HMRC HR compliance lead HM Revenue & Customs Nov 16 Present 4 years 2 months East Kilbride HRBP for Wealthy / Affluent, Public Bodies & Employment Status teams Customer Relations Manager & HR Business Partner. The Government Gateway was the system used to sign up for the UK government’s online services Most people used it to log in to HMRC and file their personal tax return.

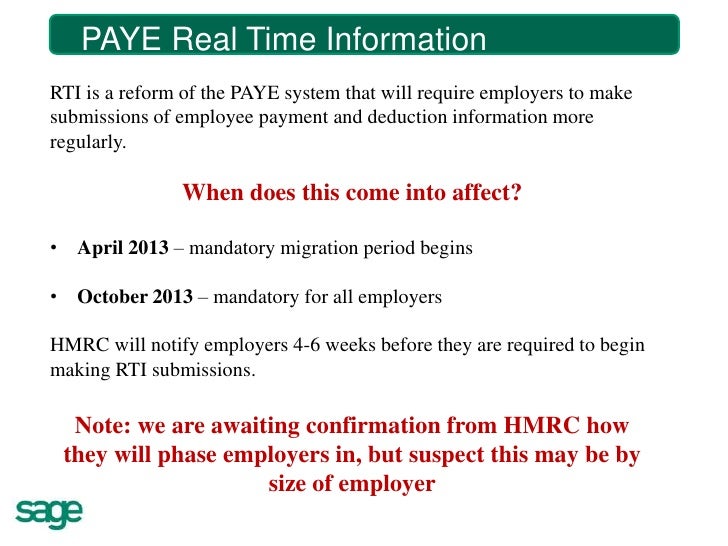

Back in June we wrote about how the HMRC are going to go after companies for Furlough fraud and the update is that the government is asking firms to declare furlough overpayments during an amnesty period, in a bid to claim back money incorrectly claimed through the Coronavirus Job Retention scheme Companies that received money they shouldn’t have — whether deliberately or by accident — can avoid penalty charges by declaring it to HMRC. The Office of Human Resources Management (OHRM) implements Governmentwide and Departmental policies, employee programs, and activities in all aspects of human resources. Key features Dashboard Ataglance information on the status of each pay group, RTI and alerts from HMRC and Civica HR & Payroll;.

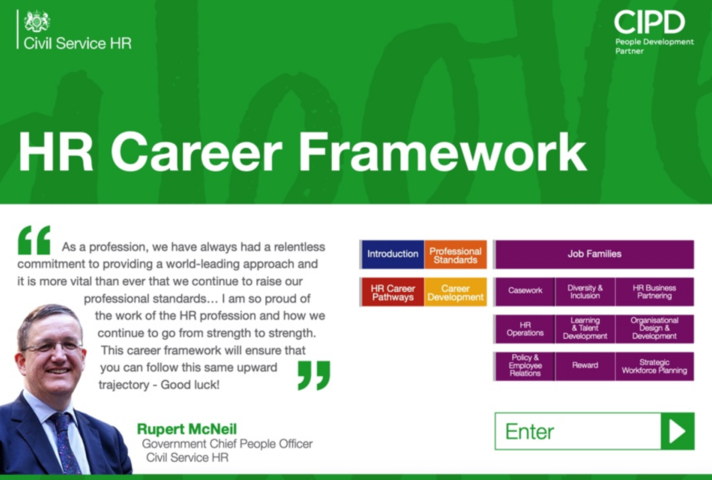

Government Gateway Automatically files returns to HMRC, updates rates and values and downloads notifications Supports Gender Pay Gap reporting and The Apprenticeship Levy Multicompany Up to 9,999 companies with different departments, locations, cost. US Army Human Resources Command "Soldiers First!" United States Army Human Resources Command "Soldiers First!" Site Map Login Logout The security accreditation level of this site is UNCLASSIFIED and below Do not process, store, or transmit any Personally Identifiable Information (PII), UNCLASSIFIED/FOUO or CLASSIFIED information on this. HMRC is basing future capability plans for HR professionals and the broader function on the CIPD’s new Profession Map The key tenets at the centre of the map – valuesled, evidencebased and outcomesdriven – are in harmony with HMRC’s people strategy.

HMRC Danielle Larocca, an SAP Mentor and published author, who offers insights into how companies can maximize their HR (including SAP HCM and SuccessFactors) investments We also invite other specialists in this field to contribute their expertise. HMRC also provide webchat services for employees whilst they are online Webchat is a personalised service with tax experts who can provide advice and guidance about tax matters, as well as how to navigate and use the online service The contact number for HMRC is 0300 0 3300. Email, call or write to HMRC if you're an aircraft operator and need help with Air Passenger Duty, including registering and making payments and returns Alcohol and Tobacco Warehousing Declaration.

If you're an employee or you pay tax on a company pension through PAYE, you can check how long it will take HMRC to pay your Income Tax refund;. The HMRC Situational Judgement Test will examine your main characteristics and skills in dealing with unknown life situations that you are likely to encounter when working for HMRC This test is designed to check if you suit the core values that HMRC are looking for (we covered these above!). The Government Gateway was the system used to sign up for the UK government’s online services Most people used it to log in to HMRC and file their personal tax return It was shut down on March 19 So how do I log in to HMRC now?.

HMRC is the UK's tax, payments and customs authority, and we have a vital purpose we collect the money that pays for our public services and help families and individuals with targeted financial. HR departments must keep track of these changes, particularly those that took effect before the end of the tax year, to ensure PAYE is being correctly calculated National Insurance liabilities Employers will also be liable to Class 1A National Insurance, charged at 138% of the value of the taxable benefits reported on the P11D forms. HR Shared Services Admin Call Handler £7 per hour Free Car Parking!.

HMRC will publish the following information about an employer who makes a claim under the scheme in December and January name of the employer or qualifying PAYE scheme;. The HR Solutions consultancy team is dedicated to delivering the flexible and practical employment support that your business needs We offer you a range of outsourced HR consultancy packages, business support functions and adhoc services that help take the stress out of managing your workforce. Rewardstrategycom an online news and information service for the UK’s payroll, reward, pensions, benefits and HR sectors rewardstrategycom is published by Shard Financial Media Limited, registered in England & Wales as , Axe & Bottle Court, 70 Newcomen St, London, SE1 1YT.

Expert, personable HR and training solutions that are tailored to your business From crisis to compliance, coaching to qualifications, we offer customised human resources and learning and development support for businesses, schools and charities of all shapes and sizes. My client a The HR Shared Services team cover the wide range of tasks such as time and. HMRC is providing information and support now to ensure businesses have plenty of time to prepare for the changes coming into effect in April 21 Many contractors and organisations have already begun doing so, and any preparation now will remain valid for April 21 when the rules change.

We have recently submitted two separate transaction in securities clearances where HMRC have responded with several questions/objections around the proposed structure of the business The Clearance Unit appear to be suggesting that a group structure is not required in both cases, and the corresponding Officer for one application has even suggested an alternative business structure. We offer opportunities to join the profession through the Human Resources Fast Stream and Fast Track Apprenticeship These schemes will give you the chance to build professional HR skills whilst. Let Reio take care of payroll calculations and submissions to HMRC Core HR Manage employee work time, approve holidays and sick day requests from within Reio Integrations Reio is integrated with Xero, Google Suite and other popular software packages FIND OUT MORE Pricing.

At HMRC we're committed to getting tax right, for everyone We’re all doing our bit to make a difference, whether that’s helping customers pay their tax and claim financial support or making it hard for the dishonest minority to cheat the system We couldn’t do all this without our dedicated and very important workforce. You get a login for HM Revenue and Customs (HMRC) online services when you register for tax online You register when you tell HMRC that you want a personal tax account are an individual who needs. The Personal Tax (PT) division of HMRC handles tax relating to individuals, such as PAYE, SelfAssessment and National Insurance PT Operations employs about 14,000 people ‘We run all the customerfacing contact centres for HMRC, so that is for the whole organisation and not just for personal tax.

HMRC is the UK's tax, payments and customs authority, and we have a vital purpose we collect the money that pays for our public services and help families and individuals with targeted financial support • Be an experienced HR professional who has a proven experience of shaping solutions within an operational environment • Experienced. HR Director, HMRC Customer Services Group United Kingdom 6 connections Join to Connect HM Revenue & Customs Report this profile Activity Line manager, leader, your boss can make or break your experience in work How will you make your team's experience great today?. Data can get scattered across your organisation, causing unwanted financial and reputational risks SiriusPayroll365 is an HMRC approved payroll software that streamlines your payroll processes, so your HR and Finance departments can ensure accuracy, timeliness, and compliance.

What HM Revenue & Customs does We are the UK’s tax, payments and customs authority, and we have a vital purpose we collect the money that pays for the UK’s public services and help families and. Provide a copy of individual information, such as your tax code or pay and tax details;. Head of HR Policy HMRC Apr 18 – Present 1 year 7 months Canary Wharf London Head of Employee Relations HMRC Feb 15 – Present 4 years 9 months Head of Talent and Capability.

HMRC digital jobs As a digital employer with some of the best delivery centres in the UK and some of the biggest and most exciting digital projects in Europe we’ve got a lot to offer Why work for HMRC digital?. Wealden HR & Payroll Solutions 343 followers on LinkedIn Innovative Cloud Based HR and Payroll Software Solutions Company Since 19, Wealden has been providing industryleading HR, Payroll. Tax pays for vital public services that include hospitals, schools, police, transport, defence and security HMRC is responsible for calculating and collecting taxes and duties paid by more than 50.

High performing organisations have the right people in the right jobs, working within an effective structure and a healthy culture effectusHR can help your organisation address and resolve people, structure and culture related challenges using an updated, fresh and pragmatic approach to provide you with bespoke solutions Mae gan gwmniau sy'n perfformio'n dda y bobl gywir yn y swyddi cywir. Triad HR works with you, the Client, to manage Software Providers and Systems Implementers We partner with you, the client, at every step of the HR technology life cycle from assisting with building your strategy and selecting your partners to implementing new HCM technology We represent your needs by helping you move from technology strategy. Back in June we wrote about how the HMRC are going to go after companies for Furlough fraud and the update is that the government is asking firms to declare furlough overpayments during an amnesty period, in a bid to claim back money incorrectly claimed through the Coronavirus Job Retention scheme Companies that received money they shouldn’t have — whether deliberately or by accident.

Her Majesty’s Revenue and Customs (HMRC) has told businesses to prepare for “important changes” to IR35 In an October Bulletin, HMRC has told businesses that they must prepare for the important changes that are occurring to the offpayroll working rules in 21. Register for HMRC online services Sign in to HMRC online services Once you’ve registered, you can sign in for things like your personal or business tax account, Self Assessment, Corporation Tax,. HR Shared Services Admin Call Handler Morley, Leeds £7 per hour Free Car Parking!.

Current vacancies Industrial placements 21 Useful links All GOVUK blogs;. Working for HM Revenue and Customs Tax is a fact of life and it’s what keeps the UK running It pays for hospitals, schools and other public services We calculate and collect the tax and duties. HMRC to publish employers CJRS claims 08 Dec by Amber Pritchard HMRC has confirmed that, from February 21, it will publish the names of employers claiming through the Coronavirus Job Retention Scheme (CJRS) It will only publish employers that claims cover periods from December onwards.

Whatever the size of your coop, we know dealing with HR can sometimes be tough Our HR package can help your coop to be both legally compliant and a great place to work. We offer opportunities to join the profession through the Human Resources Fast Stream and Fast Track Apprenticeship These schemes will give you the chance to build professional HR skills whilst. Reply to your general Income Tax enquiry;.

HMRC can also seek to charge up to £300 plus a further penalty of £60 per day for as long as the failure to submit each P11D continues Employers need to ensure they have fully reviewed any salary sacrifice arrangements and have considered the impact of the OpRA legislation Failure to do this could lead to hefty fines.

Furlough Related Fraud Cases Leap To 7 000 Coronavirus Hr Grapevine

Hmrc Crack Down On Furlough Fraud Bradfield Hr

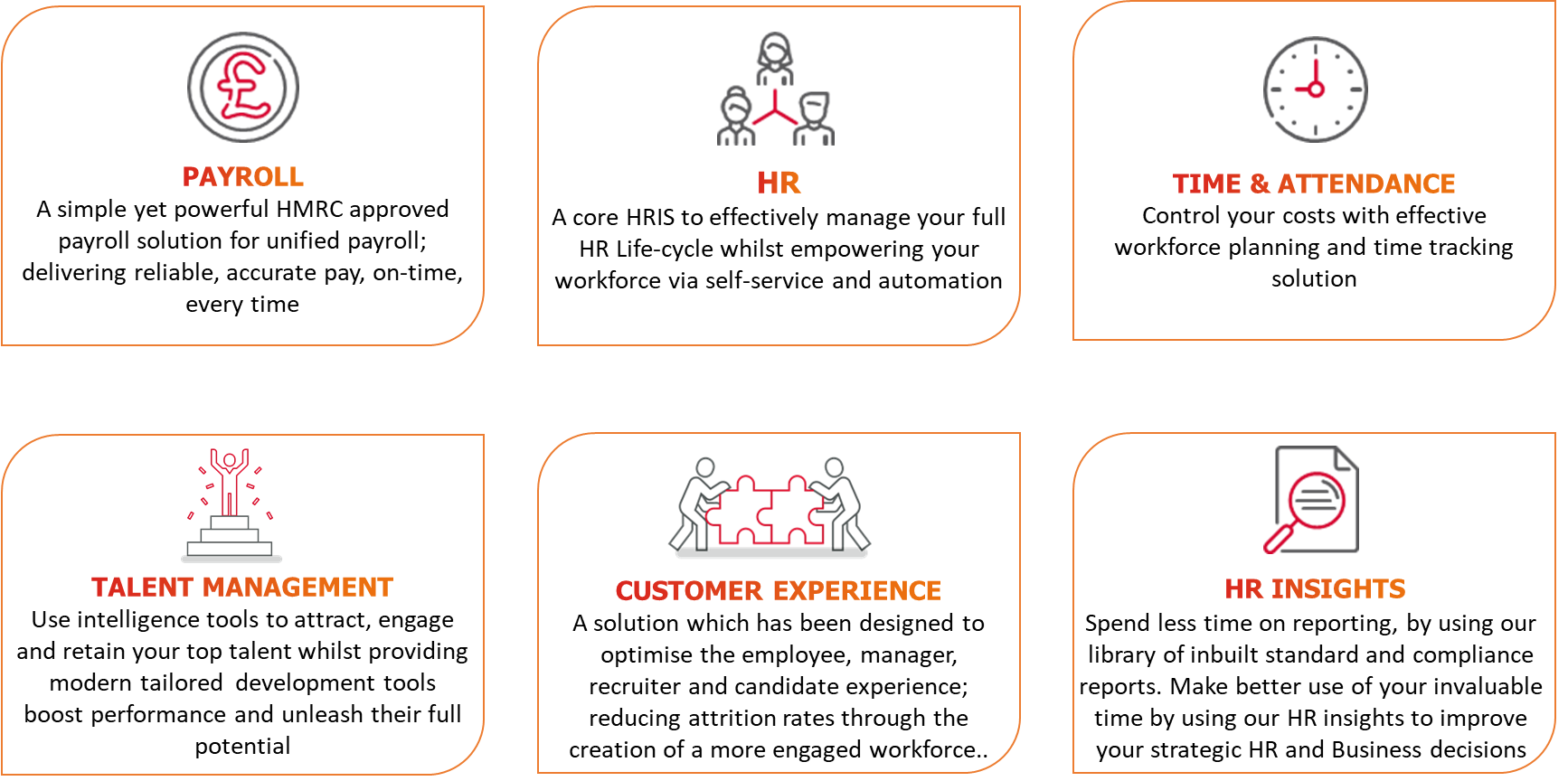

Hr Software Payroll Software Hris Hr System Hr Solutions Hr Payroll Software

I Don T Know About The Rest Of You But When I Hear Hmrc Mentioned I Just Feel Nauseous Dawn Mclaughlin Co Chartered Accountants

Ciphr Payroll Receives Hmrc Rti 21 Recognition Ciphr

Human Resources Sopra Steria

Employed Or Self Employed Revisited Painless Payroll

Hmrc Archives Go Legal Hr

Deal Signed On Birmingham Civil Service Hub For Hmrc And Dwp

International Hr Adviser Spring 16 By International Hr Adviser Issuu

Hmrc Job Retention Scheme Portal Mad Hr

Concerns Raised Over Personal Data Breaches At Hmrc Ftadviser Com

Hackers Exploit Hmrc Coronavirus Job Retention Scheme With Phishing Email Scam Techradar

William Hague Chief People Officer Hm Revenue Customs

Q Tbn And9gcqdvf Wc9vrp4d3xzzzp9hzl Iubmzlvxw Daksud8xjxiwtnop Usqp Cau

Women In Leadership The Brilliant Natasha Harris Hr Director Hmrc Talking To Wil Delegates About The Importance Of Authentic Leadership T Co Qio7ybfztt

Contacting Hmrc About Tax Iris Fmp Uk

Payroll Module Cloud Payroll User Guides Staffology Payroll

Civil Service Hr Gov Uk

Almost 1 900 Reports Of Furlough Fraud To Hmrc Personnel Today

Three Tips For A Stress Free Year End Croner I

Auto Enrolment Hmrc Guide Hr Marketplace A One Stop Shop For All Your Hr Requirements

Hmrc Shown Red Card Over Premier League Referees Dispute Compensation Benefits Hr Grapevine

Taking Pride In Being People Experts

Xcd Legislation Changes That Hr Payroll Managers Need To Be Aware Of In 19 T Co Gkvp6drsak Hmrc Tax Welshincometax Postgraduateloans Parentalleave Executivepay T Co Dytxo4hbfx

2

Working In Human Resources Civil Service Careers

News Resources Page 2 Of 6 Optimal Pbs

How Hr Advisors Can Help Clients With Off Payroll Ir35 Rules 7 Simple Steps

Files Civilservicejobs Service Gov Uk Admin Fairs Apptrack Download Cgi Sid duzxi9nta3mdawmczvd25lcnr5cgu9zmfpcizkb2nfdhlwzt12ywmmzg9jx2lkptgzmtexmcz2zxjpznk9nzbmzjblogu5zdc5ntaymda2odqyzgixnzcwmgq5zdm

Hmrc And Self Employment How Hr Can Get It Right

Www Pwc Co Uk Assets Pdf En Jhr News Pdf

Furlough Fraud Warning From Hmrc

2

Monitoring Arrangements Responsibilities

Hmrc Off Payroll Working Rules Hr Solutions Payroll Services

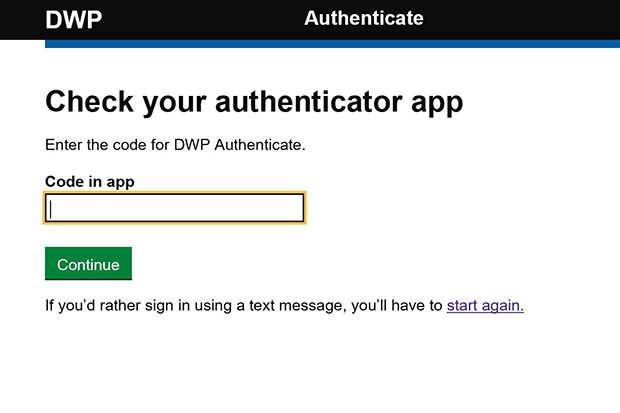

Why Identity And Trust Are So Important For Dwp S Digital Transformation Dwp Digital

Taking Pride In Being People Experts

Working In Human Resources Civil Service Careers

2

Www lplaw Com En Us Insights Uk New Hmrc Guidance On Dual Contracts Html

How To File An Emi Notification To Hmrc By Capdesk Medium

Cezanne Hr Pricing Features Reviews Comparison Of Alternatives Getapp

Cezanne Hr Breaks New Ground In Hr Software Again With A Cloud Native Payroll Module

Hmrc Publishes Respect At Work Report Gov Uk

Sanctions In Place For The National Living Wage Hr Solutions

Furlough Can Now Be Used To Help Homeschooling Parents Hmrc Personnel Today

Working In Human Resources Civil Service Careers

Hmrc Audit The Cjrs Absolute Works Hr Employment Kenilworth Warwickshire

Hmrcleaks Blog Of A Civil Service Whistleblower In Her Majesty S Revenue And Customs Hmrc E Mail From Hmrc Whistleblower Andi Ali To Hmrc Manager Francine Pugh Dated 1 August 05 Pointing Out That

Video Hr Case Management Demo Sunrise Software

Hmrc Behaviour Report Highlights Abusive And Abrasive Behaviour At Hmrc

Phishing Trends To Be Aware Of Hmrc Tax Refunds

Hmrc Update

Www Capgemini Com Gb En Wp Content Uploads Sites 3 08 07 Hmrc E2 80 99s Innovative Approach To It Partner Management Pdf

Who Will Be Next Under The Hmrc Spotlight Regarding Self Employment Status

Www Gov Uk Government Uploads System Uploads Attachment Data File Hmrc Organisation Chart 15 03 15 Pdf

Hr Software That Integrates With Xero Citrushr

Q Tbn And9gcte8qmkclkgkmtbfr0dksyf7r1jnorlmbajekqiydiar Kwelro Usqp Cau

Covid 19 Latest Updates

P45 Tax Form Is Given A Reprieve By Hmrc Hrreview

Carval Announces Recognition From Hmrc For Construction Industry Payroll Supporting Growth Into New By Prping Issuu

Hmrc Guidance On The Kickstart Scheme Ward Williams Hr Advisers

2

Fillable Online Hmrc Gov Apss251 Qualifying Recognised Overseas Pension Scheme Qrops Use This Form To Notify Hm Revenue Customs Of Recognised Overseas Pension Schemes Hmrc Gov Fax Email Print Pdffiller

Management H R Human Resources

Q Tbn And9gcsf43jiiwpfncfv Vzsu3dibaflev2u0bddhdz8f1aavnlu0kft Usqp Cau

British Business School Receives Recognition For Work With Hmrc Training Journal

Cipd 13 Highlights Unilever Facebook And Hmrc Personnel Today

Rupert Mcneil Government Chief People Officer Civil Service Human Resources Cabinet Office Civil Service

Working In Human Resources Civil Service Careers

Former c Presenter Ordered To Pay 400k In Unpaid Ir35 Tax To Hmrc

Unleashing The Power Of Sage Payroll And Hr

Hm Revenue And Customs Wikipedia

Furlough Hmrc Clarifies Tupe Rules And Warns Against Fraud Personnel Today

Diskel Limited Payroll Opera 3 Payroll And Hr Hmrc Compliant

Hr Updates

Hundreds Report Employers To Hmrc Over Furlough Fraud Personnel Today

Working In Human Resources Civil Service Careers

About Us Human Resources Profession Gov Uk

Www Whatdotheyknow Com Request Response Attach 4 1798 tsigarides annex a Pdf Cookie Passthrough 1

Hmrc Tax Professional Graduate Programme Hmrc Tax Professional Graduate Programme Facebook

Coronavirus Job Retention Furlough Scheme Nori Hr

V4skxvdtp2ii2m

Interview Esther Wallington Chief People Officer Hmrc From Disruptive Hr Podcasts Podcast Episode On Podbay

Working In Human Resources Civil Service Careers

Moorepay Here S Our Small Business Guide To Hmrc Investigations Which Talks You Through The Process And How To Reduce The Risk Of An Investigation T Co Fzttzpoj90 Hmrc T Co Zbvvsyc4il

Working In Human Resources Civil Service Careers

Q Tbn And9gctx0be 0 Qauza4m1qq14ofg9ljn5clfqz35d9dwis Usqp Cau

Http Hes Org Uk Article Download 0bf6 cb 4d18 19 Ba68d9056e

Www Imperial Ac Uk Media Imperial College Administration And Support Services Hr Public Overseas Tax And Ni Pdf

Lorraine Kelly Win Over Hmrc Is Welcome News For Uk Contracting Community Hr News

Workers Paid Below National Minimum Wage Hr Solutions

Hr News The Peoples Partner

Online Payroll Cloud Automation Employee App

Real Time Information Rti User Guide For Submitting To Hmrc Via Manualzz

The Hr Kioskfilm Television And Production Industry Guidance From The Hmrc

Payroll Hmrc Rules Payroll Calculator Hr Jobs